Refinancing a leased car can seem like a daunting task, but with the right information and guidance, it can be a smart financial decision. When you initially signed your car lease, you agreed to specific terms and conditions that dictate your monthly payments. However, as time goes on, your financial situation may change, and you could be left with a payment plan that no longer suits your needs.

Refinancing your leased car could help you save money in the long run by reducing your monthly payments, lowering your interest rate, or altering the length of your lease. In this article, we’ll explore the steps needed to refinance a leased car and provide insights and tips along the way. Let’s dive in!

Table of Contents

Understand the Current Lease Agreement

If you’re looking to refinance a leased car, the first step is to understand your current lease agreement. Review the terms and conditions carefully to ensure you’re complying with all the requirements set by your lessor. Look for details such as the interest rate, monthly payments, and any fees or penalties associated with early termination of the lease.

Understanding these details will help you make informed decisions when refinancing your leased car. You’ll also want to consider the value of your vehicle and its current condition. If you’ve maintained your car properly and it’s in good shape, you’ll be in a better position to refinance at a lower interest rate.

Remember, refinancing a leased car can save you money in the long run, but it’s important to do your research and understand the terms and conditions of your lease agreement. With careful planning and attention to detail, you can successfully refinance your leased car and enjoy lower monthly payments and a better overall experience.

Gather Information About Your Lease

Understanding the current lease agreement is an essential step in the process of gathering information about your lease. This agreement outlines all the crucial terms and conditions of your lease, including the rent amount, security deposit, lease duration, late payment fees, and renewal terms. Careful consideration of these aspects ensures that you understand your financial obligations and responsibilities as a tenant.

In addition, you should also be aware of any restrictions and clauses regarding maintenance, alterations, subletting, and pet policies. To better understand your lease agreement, it may be helpful to seek legal advice or ask your landlord to clarify any ambiguous terms. By having a thorough understanding of your lease agreement, you can avoid misunderstandings or disputes in the future and ensure a smooth tenancy experience.

Read the Lease Agreement Carefully

When it comes to leasing a home or apartment, it’s essential to read the lease agreement carefully. Understanding the current lease agreement can help you make an informed decision about whether the property is right for you. Lease agreements typically outline the terms and conditions of the rental property, including rent, move-in dates, and any additional fees or charges.

Reading the document in its entirety can also help you get a better sense of your responsibilities as a tenant. It’s essential to take the time to look for any fine print or hidden clauses that may impact your experience living in the rental property. By understanding the lease agreement, you can make sure you’re getting what you need from the property while staying within the terms of the lease.

Look for a Lender to Refinance With

If you’re looking to refinance a leased car, the first step is to search for a lender that accepts lease buyouts. Some lenders may not offer this type of financing, so it’s important to do your research and find a lender that fits your needs. Once you’ve found a potential lender, check their rates and terms to make sure they align with your budget and goals.

It’s also important to review your credit score and history before applying for refinancing, as this can impact your eligibility for certain loans. When you’re ready to apply, gather any necessary documentation, such as proof of income and lease agreement information, and submit your application. If approved, your new lender will pay off your current lease and issue you a new loan with potentially lower interest rates and better terms.

Refinancing a leased car may take some effort, but it could save you money in the long run and provide more flexibility with your car ownership.

Research Lenders

Finding the right lender to refinance your mortgage can be a daunting task, but it’s definitely worth the effort. Start by doing some research online to find out what lenders offer refinancing options. Look for a lender that has experience with your specific situation, such as your credit score, loan amount, and property type.

You can also ask for recommendations from friends or family members who have recently refinanced. Once you have a list of potential lenders, it’s important to compare their rates and terms. Don’t be afraid to negotiate with lenders to get the best deal possible.

Keep in mind that a lower interest rate may not always be the best option, as some lenders may have hidden fees or charges. Ultimately, it’s important to choose a lender who you feel comfortable working with and who can help you achieve your financial goals.

Compare Rates and Terms

When considering refinancing, it’s crucial to shop around for the right lender. Look for a lender that offers competitive rates and terms that suit your financial needs. Don’t just settle for the first lender you come across; take your time and compare different options.

You may be able to save yourself a lot of money over the life of the loan by finding a more favorable rate. One way to compare lenders is to use an online loan comparison tool that can provide you with personalized loan offers from different lenders. Another good practice is to reach out to multiple lenders directly and then compare their offers side-by-side.

Ultimately, the best lender for your refinancing needs will depend on your credit score, income, equity, and the value of your home. So take the time to do your research and find the lender that’s the best fit for your unique situation.

Check for Eligibility Requirements

Before you start searching for a lender to refinance with, it’s essential to check whether you meet the eligibility requirements. Lenders typically have specific criteria, such as a minimum credit score and income level, to qualify for refinancing. Make sure to review the lender’s requirements to determine if you’re likely to be approved for refinancing.

Checking your credit report and ensuring that your debt-to-income ratio is low can increase your chances of being eligible. It’s worth keeping in mind that refinancing is not always the best option for everyone, and you should consider your financial situation before applying. Don’t forget to shop around for lenders and compare their rates to get the best deal for you.

With thorough research and planning, you can find the right lender to refinance with and achieve your financial goals.

Apply for Refinancing

Are you considering refinancing a leased car? There are a few things to keep in mind before you apply. First of all, make sure you have a good credit score, as this will impact the interest rate you qualify for. It’s also important to understand the terms of your current lease, as there may be fees or penalties for early termination.

Additionally, research different lenders and compare their rates and fees before making a decision. Once you’ve found a lender that meets your needs, you may be able to apply online or over the phone. Overall, refinancing a leased car can be a smart financial move if you’re looking to lower your monthly payments or interest rate.

Just be sure to do your due diligence before signing any new agreements.

Fill Out an Application

Are you feeling overwhelmed with high-interest rates on your loans? It may be time to consider refinancing. Refinancing can help consolidate all your outstanding loans into one, which can help simplify your monthly payments and lower your interest rate. If you’re considering refinancing, the first step is to fill out an application.

The application process typically involves answering a few simple questions about your current loans, income, and credit score. Once you submit your application, the lender will review your information and determine if you qualify for a refinancing loan. If you’re approved, the lender will provide you with a loan offer, which will outline the terms and conditions of the loan, including the interest rate, repayment period, and any fees associated with the loan.

It’s important to carefully review the loan offer and make sure you understand all the terms before accepting the loan. Refinancing can be a great way to save money on your loans, but it’s important to do your research and make an informed decision. So why not take the first step and fill out an application today?

Provide the Necessary Documents

So, you’ve decided to take the plunge and apply for refinancing. Good on you! But before you get too excited, remember that refinancing involves a fair amount of paperwork. Lenders need to ensure that you’re a reliable borrower and that the risk of lending to you is minimal.

That’s why the first step in the refinancing process is to provide your lender with all the necessary documents. These may include recent pay stubs, tax returns, bank statements, and proof of homeowners insurance. Make sure to double-check what documents your lender requires and provide them in a timely manner to avoid any delays.

And remember, the more organized and prepared you are, the smoother the process will be. By providing all the necessary documents promptly, you’ll be one step closer to refinancing your loan and taking control of your finances.

Complete the Refinancing Process

Refinancing a leased car may feel overwhelming, but with the right approach, it can be a simple and straightforward process. The first step is to shop around and compare offers from different lenders, taking into account the interest rates, fees, and terms of each loan. Once you’ve found a suitable offer, reach out to the lender to begin the application process.

This will likely involve submitting personal and financial information, such as your income, credit score, and employment status. After the lender has reviewed your application and approved your loan, you can use the funds to pay off your existing lease and take ownership of the car. Finally, be sure to keep up with your new loan payments and maintain the car as required by the lender.

By following these steps, you can save money on your monthly payments and potentially achieve greater financial freedom. So, why not take the leap and refinance your leased car today?

Sign the New Agreement

If you’re in the process of refinancing your home, the last step is to sign the new agreement. This agreement will outline the terms of your new loan, such as the interest rate, monthly payments, and length of the loan. Before signing, make sure you understand all the terms and ask any questions you may have.

It’s important to take your time and not rush through the process. Once you sign, you’re legally bound to the terms of the loan. Remember, this is a great opportunity to potentially lower your mortgage payment, so don’t hesitate to refinance if it makes financial sense for you.

Happy refinancing!

Make Payments on the New Loan

Now that you’ve successfully gone through the refinancing process, it’s time to start making payments on your new loan. Make sure to carefully review the terms of the new loan and understand your repayment responsibilities. Some lenders offer options such as automatic payments or payment extensions if you run into unexpected financial difficulties over the course of repaying the loan.

Keep track of your payment due dates and set up reminders so you don’t accidentally miss a payment. Remember, consistently making on-time payments towards your refinanced loan will help improve your credit score over time, making you more likely to receive favorable interest rates in the future.

Consider the Pros and Cons of Refinancing

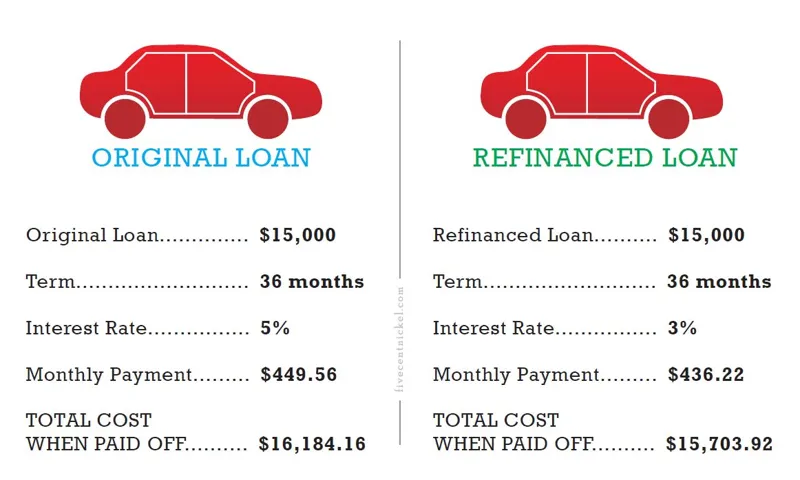

If you’re wondering how to refinance a leased car, there are some pros and cons to consider. Refinancing can lower your monthly payments, reduce the length of your lease term, and potentially save you money in the long run. However, it’s important to weigh the benefits against the potential downsides.

One drawback of refinancing is that it may extend the overall length of your lease, which means you’ll be making payments for a longer period of time. Additionally, refinancing may require you to pay fees or penalties, which can add up quickly. Ultimately, the decision to refinance a leased car should be based on your unique financial situation and goals.

It’s important to carefully evaluate the costs and benefits before making a final decision.

Pros: Lower Payments and Interest Rates

Refinancing your mortgage can have its pros and cons, and one of the advantages to consider is the potential for lower payments and interest rates. When you refinance, you may be able to secure a lower interest rate than what you currently have, which could ultimately save you money in the long run. Additionally, if you extend the repayment term of your loan, your monthly payments may also decrease.

This can be especially helpful if you’re looking to reduce your monthly expenses or free up some cash flow. However, it’s important to weigh the potential savings against the costs of refinancing, such as closing costs and fees. Ultimately, whether refinancing is the right choice for you depends on your individual financial situation and goals.

Cons: Possible Fees and Extended Loan Terms

Refinancing can be a great way to save money on your mortgage, but it’s important to consider the pros and cons before making a decision. One of the potential drawbacks of refinancing is that there may be fees associated with the process, such as an application fee or origination fee. However, it’s important to weigh these fees against the potential savings that refinancing could provide over the life of your loan.

Another factor to consider is that refinancing could also extend the term of your loan, which could mean paying more interest in the long run. On the other hand, if you’re struggling with high monthly payments, extending your loan term could help make those payments more manageable. Ultimately, the decision to refinance depends on your unique financial situation and goals.

It’s a good idea to work with a reputable lender who can help you weigh the pros and cons and make an informed decision that’s right for you.

Conclusion

In conclusion, refinancing a leased car is like giving your ride a second chance at love. You can lower your monthly payments, reduce your interest rate and get a better deal on your lease. Just like a relationship, if you’re not happy with the terms of your lease, it’s time to break up with your current lender and find a new one who will treat you right.

So, put on your confidence, shop around and make a move towards a happier ride. Refinancing a leased car might just be the best decision you ever make for your wallet and your wheels. Happy driving!”

FAQs

What is refinancing a leased car?

Refinancing a leased car means getting a new loan to pay off the existing lease agreement.

Why should I consider refinancing a leased car?

Refinancing a leased car can save you money by lowering your monthly payments or reducing your interest rate.

When is the best time to refinance my leased car?

It is best to refinance your leased car when interest rates are low or when you have a good credit score.

Can I refinance a leased car with bad credit?

It may be possible to refinance a leased car with bad credit, but you may not be able to get the best interest rates.

Will refinancing my leased car affect my credit score?

Refinancing your leased car may affect your credit score, but it will depend on the type of loan and how you pay it off.

How long does it take to refinance a leased car?

The time it takes to refinance a leased car will vary, but it usually takes a few weeks to complete the process.

What are the fees associated with refinancing a leased car?

Refinancing a leased car may require you to pay fees such as application fees, processing fees, and title transfer fees. Be sure to read the terms and conditions carefully before refinancing.