Have you ever wondered what exactly is covered by your auto insurance policy? It can be quite confusing to navigate the world of auto insurance and understand all the different types of coverage available. But fear not, because in this blog post, we will break it down for you and help you understand the ins and outs of auto insurance coverage. Auto insurance coverage is essentially a contract between you and your insurance company that protects you financially in the event of an accident or theft.

It is important to have the right coverage to ensure that you are adequately protected. One of the main types of auto insurance coverage is liability coverage. This is the coverage that pays for damages and injuries to the other party if you are at fault in an accident.

It is required by law in most states and is essential to have to protect yourself financially in case of an accident. Another important type of coverage is collision coverage. This coverage pays for damages done to your vehicle in the event of a collision, regardless of who is at fault.

It is especially important if you have a new or expensive vehicle, as it can help cover the cost of repairs or replacement. Comprehensive coverage is yet another type of auto insurance coverage that you should consider. This coverage protects you from damage to your vehicle that is not the result of a collision, such as theft, vandalism, or natural disasters.

It is especially important if you live in an area prone to these types of incidents. There are also additional types of coverage that you can add to your policy, such as uninsured/underinsured motorist coverage, which protects you if you are in an accident with a driver who does not have insurance or does not have enough insurance to cover the damages. Understanding auto insurance coverage is crucial for every driver.

It’s important to review your policy and make sure you have the right coverage for your needs. By doing so, you can have peace of mind knowing that you are protected financially in the event of an accident or theft. So, the next time you think about auto insurance, think about the protection it offers and the peace of mind it brings.

Table of Contents

What Does Auto Insurance Cover?

When it comes to auto insurance, it’s important to know what is and isn’t covered. One common question many drivers have is whether their insurance policy will cover the cost of rock chip repair on their windshield. In most cases, the portion of auto insurance that typically pays for rock chip repair is comprehensive coverage.

While liability insurance covers damages you might cause to others in an accident and collision insurance covers damages to your own vehicle in a collision, comprehensive coverage is designed to cover non-collision-related damages. This can include things like rock chips, hail damage, and even theft or vandalism. However, it’s important to read your policy carefully, as some insurance companies may have specific limitations or deductibles for certain types of non-collision damages.

So if you find yourself with a rock chip on your windshield, it’s likely that your comprehensive coverage will help cover the cost of repair.

Liability Coverage: Protecting Others

auto insurance coverage, liability coverage, protecting others. In the world of auto insurance, liability coverage is one of the most important components. It’s like having a safety net that protects you and others from financial loss in the event of an accident.

This coverage is designed to pay for damages or injuries that you may cause to other people and their property. Imagine if you accidentally rear-ended another vehicle or hit a pedestrian crossing the street. Without liability coverage, you could be held personally responsible for paying for their medical expenses, vehicle repairs, and any other damages that may have occurred.

That’s where liability coverage steps in. It shields you from bearing the burden of these costs, allowing your insurance company to handle the financial fallout. It not only protects your own assets but also gives you peace of mind knowing that others are taken care of in the aftermath of an accident.

So, when you’re considering your auto insurance policy, make sure to prioritize liability coverage to ensure that you and others are adequately protected.

Collision Coverage: Repairing Your Vehicle

collision coverage, auto insurance cover, repairing your vehicle

Comprehensive Coverage: Damage from Non-Collision Events

comprehensive coverage, auto insurance, non-collision events When it comes to auto insurance, it’s important to understand what exactly is covered. One type of coverage that can be extremely beneficial is comprehensive coverage. This type of insurance provides protection against damage to your vehicle caused by events other than collisions.

So, if your car is damaged by a hailstorm, a falling tree, or even vandalism, comprehensive coverage can help cover the costs of repairing or replacing your vehicle. It’s like having a safety net for those unexpected non-collision events that can leave you with a hefty repair bill. With comprehensive coverage, you can have peace of mind knowing that you’re protected against a wide range of potential risks.

Windshield Repair and Replacement

Have you ever had a rock chip on your windshield and wondered if your auto insurance would cover the repair? Well, the good news is that most auto insurance policies include coverage for rock chip repair on the windshield. This coverage is typically included under the comprehensive portion of your policy, which helps cover damages that are not caused by a collision. So, if you have comprehensive coverage, you can usually get your rock chip repaired at no cost to you.

It’s important to note that the specific coverage and deductible amounts can vary depending on your policy, so it’s always a good idea to check with your insurance provider to understand what is covered. Overall, having coverage for rock chip repair can save you money and help keep your windshield in tip-top shape.

Causes of Windshield Damage

windshield damage, windshield repair, windshield replacement, causes of windshield damage. The windshield of your car is more than just a piece of glass. It is an essential part of your vehicle’s safety system.

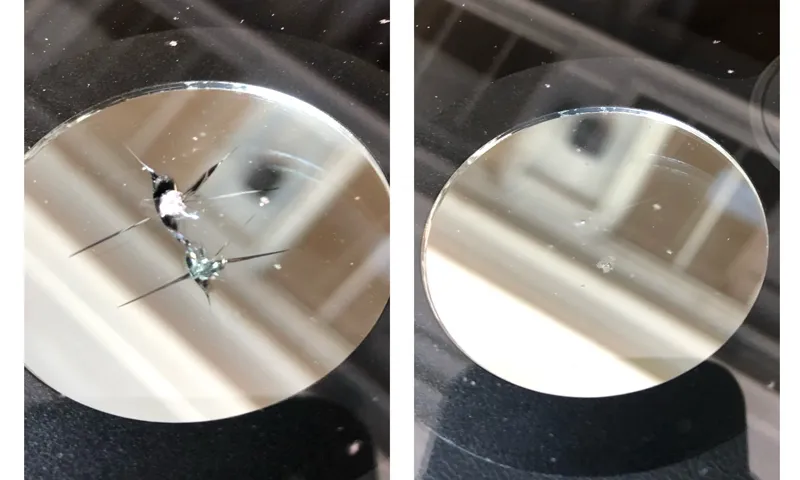

But like any other part, it can get damaged over time. There are several common causes of windshield damage that every car owner should be aware of. One of the most common causes is flying debris on the road.

Whether it’s a rock kicked up by another vehicle or a stray object that falls from a passing truck, flying debris can cause cracks or chips in your windshield. Another common cause is extreme temperature changes. When your car is exposed to sudden changes in temperature, the glass can expand or contract, leading to stress cracks.

Hailstorms are also a major culprit when it comes to windshield damage. Hailstones can cause significant damage to your windshield, leaving it cracked or shattered. And finally, accidents are a leading cause of windshield damage.

Whether it’s a minor fender bender or a major collision, the impact can cause the windshield to crack or break. Regardless of the cause, it’s important to address windshield damage promptly. In many cases, small chips or cracks can be repaired quickly and easily.

However, if the damage is extensive or affects your visibility, windshield replacement may be necessary. Don’t wait until it’s too late – take care of your windshield to ensure your safety on the road.

Insurance Coverage for Windshield Repair

windshield repair, insurance coverage

Deductibles and Limits

When it comes to auto insurance, it’s important to understand the deductibles and limits, especially when it comes to windshield repair and replacement. Deductibles refer to the amount of money you must pay out-of-pocket before your insurance coverage kicks in. For example, if your deductible is $500 and you have a $1,000 windshield repair job, you will need to pay $500, and your insurance will cover the remaining $500.

On the other hand, limits refer to the maximum amount of money your insurance will pay towards a claim. So, if your limit is $1,000 and you have a $1,500 windshield replacement cost, you will be responsible for paying the additional $500. It’s important to review and understand these deductible amounts and limits on your auto insurance policy so that you’re prepared in case you need to repair or replace your windshield.

Does Auto Insurance Cover Rock Chip Repair?

When it comes to rock chip repair on windshields, many people wonder if their auto insurance will cover the cost. The answer to this question may depend on the specific policy and coverage you have. In most cases, the portion of auto insurance that typically pays for rock chip repair is comprehensive coverage.

This type of coverage is designed to protect against non-collision incidents, such as theft, vandalism, and weather damage. Since rock chips are usually considered a result of road debris and not a collision, they fall under the realm of comprehensive coverage. However, it’s always important to review your policy and speak with your insurance provider to determine exactly what is covered in your specific situation.

Comprehensive Coverage: Windshield Damage

auto insurance, comprehensive coverage, windshield damage, rock chip repair Does auto insurance cover the cost of rock chip repairs to your windshield? This is a question that many drivers may have, especially if they have experienced a sudden crack or chip in their windshield. The answer to this question actually depends on the type of auto insurance coverage you have, specifically if you have comprehensive coverage. Comprehensive coverage is an optional form of car insurance that protects you against damage to your vehicle that is not caused by a collision.

This can include things like theft, vandalism, and yes, even rock chips and cracks in your windshield. However, it’s important to note that not all comprehensive insurance policies cover rock chip repairs. Some policies may have a deductible that needs to be met before coverage applies.

So if you notice a rock chip in your windshield, it’s a good idea to check with your insurance provider to see if it qualifies for coverage and if there are any additional out-of-pocket costs you need to be aware of. Ultimately, it’s always recommended to have comprehensive coverage on your auto insurance policy to protect yourself against unexpected windshield damage.

Specifics of Coverage

auto insurance, rock chip repair, coverage

Choosing the Right Deductible

auto insurance, rock chip repair, deductible

Contact Your Insurance Provider

If you have a rock chip on your windshield, you may be wondering if your auto insurance will cover the repair. In most cases, the portion of auto insurance that typically pays for rock chip repair on the windshield is comprehensive coverage. Comprehensive coverage helps protect you from damages that are not caused by a collision, such as hail damage, theft, or vandalism.

It’s important to note that not all insurance policies include comprehensive coverage, so it’s best to contact your insurance provider to determine if you have this coverage and what your specific policy entails. They will be able to explain the details of your coverage and guide you on the next steps for repairing the rock chip on your windshield.

Conclusion

“Ah, the age-old question of who foots the bill for those pesky rock chips on our windshields! Well, my dear friend, the answer lies in the marvelous world of auto insurance. You see, within the vast realm of coverage options, it is the comprehensive portion of your auto insurance that typically dons the cape and swoops in to save the day when a rock decides to leave its mark on your precious windshield. Yes, this mighty superhero called comprehensive coverage graciously takes care of the expenses incurred in repairing such unsightly blemishes.

So, the next time a rock chip dares to disrupt your driving serenity, fear not! Your trusty auto insurance’s comprehensive portion shall emerge victorious, ensuring your windshield is as good as new once again. Truly, it’s a tale of bravery and dexterity in the face of a small but mighty enemy!”

FAQs

What is the windshield repair coverage typically included in auto insurance policies?

The windshield repair coverage in auto insurance policies is a provision that pays for the repair of rock chips on the windshield.

What is the purpose of the comprehensive coverage in auto insurance?

Comprehensive coverage in auto insurance typically pays for damages caused by non-collision incidents, such as rock chip repair on the windshield.

Is rock chip repair covered by liability insurance?

No, liability insurance typically covers damages to other people’s property, not chips or cracks on your own windshield.

How much does the windshield repair coverage typically pay for rock chip repair?

The amount covered for windshield repair may vary depending on the policy, but it is commonly subject to a deductible.

Do all auto insurance policies include coverage for rock chip repair on the windshield?

No, not all policies include windshield repair coverage. It is often an optional add-on or part of a comprehensive coverage package.

Can I get my windshield repaired for free with auto insurance coverage?

It depends on your policy and insurance provider. Some policies may fully cover rock chip repair without any out-of-pocket costs, while others may require a deductible.

Are there any limitations to the windshield repair coverage in auto insurance policies?

Yes, there may be limitations such as the number of repairs covered, the maximum amount paid for repair, or restrictions on repairing certain types of damage.

How do I file a claim for rock chip repair with my auto insurance company? A8. To file a claim for windshield repair, you typically need to contact your insurance provider, provide details of the damage, and follow their specific claim process.

Can I choose any repair shop for rock chip repair covered by auto insurance?

Insurance providers may have a preferred network of repair shops for windshield repair, but some policies allow you to choose your own if it meets certain criteria.

Will filing a claim for rock chip repair affect my insurance rates?

It depends on your insurance provider and policy. Some providers may consider windshield repair claims as a non-chargeable incident, while others may impact your rates.

Can I get rock chip repair covered even if the damage occurred before I had auto insurance?

This will depend on your policy terms and conditions. Some policies may only cover damages that occur after the policy effective date.

Can I get my windshield replaced instead of repaired if the damage is severe?

Auto insurance policies may cover windshield replacement if the damage exceeds repairable limits. The terms and conditions will vary depending on your policy.