If you’re thinking of purchasing a new car, you may want to consider getting Gap Insurance. Gap Insurance is a type of coverage that protects you if your car is stolen or totaled and you owe more on your loan or lease than the car is worth. One company that offers this type of policy is State Farm.

In this blog post, we’ll dive into everything you need to know about State Farm’s Gap Insurance, including what it covers, how much it costs, and whether it’s worth it for you. So, buckle up and let’s get started!

Table of Contents

What is Gap Insurance?

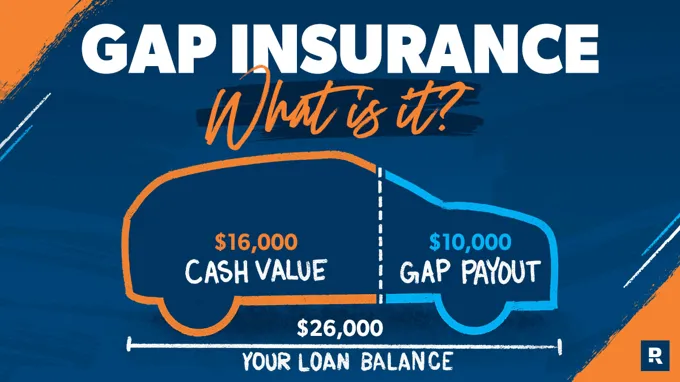

State Farm does offer gap insurance, also known as Guaranteed Asset Protection. Gap insurance is a type of insurance that covers the difference between the actual cash value of a vehicle and the amount still owed on a loan or lease agreement. This coverage can be important in situations where a car is totaled or stolen and the insurance payout is not enough to cover the outstanding loan amount.

Gap insurance can also be helpful in protecting your investment when purchasing a new or expensive vehicle. Be sure to speak with a State Farm agent to discuss whether gap insurance is right for your specific needs and situation.

Explaining the Coverage

Gap insurance is an auto insurance coverage that many people may not be familiar with. Essentially, gap insurance helps cover the difference between what you owe on your car and its actual market value in the event that it is damaged beyond repair or stolen and not recovered. Without gap insurance, you may be left paying the remaining balance on your car loan even though you no longer have the car.

This can be a financial burden that many people may not be prepared for. Gap insurance can provide peace of mind and protect your finances in the event of an unexpected loss. It is important to consult with your insurance agent to determine if gap insurance is right for you and your specific auto insurance needs.

State Farm’s Gap Insurance

As a large insurance provider, State Farm does offer gap insurance coverage. Gap insurance is designed to cover the difference between the amount owed on a car loan or lease and the actual value of the vehicle in the event of an accident or theft. This can be an important coverage option for those who have financed or leased a vehicle, as it can help to prevent financial hardship if an unexpected event occurs.

State Farm’s gap insurance coverage can be added to a policy for a relatively low cost, and can provide peace of mind for drivers who want to ensure they are fully protected on the road. So, if you’re wondering “does State Farm offer gap insurance?”, the answer is yes – and it may be worth considering as part of your overall insurance coverage.

Features and Benefits

State Farm’s Gap Insurance offers drivers peace of mind by covering the difference between the actual cash value of their vehicle and the outstanding balance on their loan or lease in case of theft or a total loss accident. This eliminates the risk of being stuck with a hefty bill that’s not covered by regular auto insurance. Gap insurance is especially useful for new cars that depreciate rapidly in value during the first few years of ownership.

State Farm’s gap insurance also provides flexibility to choose the deductible amount and payment options, making it easier for budget-conscious customers. By choosing to add gap insurance to their policy, drivers can benefit from financial protection and avoid paying out-of-pocket expenses.

Policy Coverage

State Farm’s Gap insurance provides additional financial protection for customers who finance or lease their vehicles. This coverage fills the gap between the actual cash value of the car and what is owed on it, so in the event of theft or accident, the customer does not have to pay out of pocket for the difference. State Farm’s policy covers both new and used cars, and premiums are typically rolled into the car payment for a seamless experience.

With the average new car depreciating about 20% in the first year and up to 60% over five years, gap insurance is a valuable investment that can save customers thousands of dollars in unexpected expenses if the worst should happen. So, if you’re considering financing or leasing a car, it’s worth looking into gap insurance as an additional layer of financial protection.

How to Purchase State Farm’s Gap Insurance

If you’re searching for gap insurance, you may be wondering if State Farm offers it. The answer is yes! State Farm does offer gap insurance, which can be a smart investment for many drivers. Gap insurance fills in the “gap” between what your standard auto insurance policy covers and the amount you still owe on your car loan.

That means if your car is totaled or stolen, you won’t have to pay out of pocket for the difference between what your insurance covers and what you still owe to the lender. If you’re interested in purchasing gap insurance from State Farm, simply contact your local agent or log into your online account and add it to your policy. It’s a small price to pay for added peace of mind on the road.

Availability and Cost

If you’re interested in purchasing Gap Insurance from State Farm, you can do so through your State Farm agent. It’s important to note that Gap Insurance is only available for those who have purchased or leased a new or used car from a dealership and have comprehensive and collision coverage on their auto insurance policy. The cost of Gap Insurance varies depending on factors such as the value of the car and the amount of the loan or lease.

However, as a general rule, the cost of Gap Insurance is usually a small fraction of the overall cost of the vehicle. It’s a valuable investment to make though, as it protects you from owing money on a vehicle that has been declared a total loss. In essence, Gap Insurance acts as a financial safety net that protects you from the steep depreciation of your vehicle.

Is Gap Insurance Right for You?

If you are currently a policyholder with State Farm and are wondering whether they offer gap insurance, the answer is yes. State Farm does provide gap insurance coverage, which can come in handy if you owe more on a financed vehicle than it’s worth. In the event of a total loss, gap insurance can help cover the difference between your car’s actual cash value and what you still owe on your car loan or lease.

This can save you from having to pay out of pocket for a vehicle that is no longer drivable. Whether gap insurance is right for you ultimately depends on your current financial situation and driving habits. It’s always best to weigh the pros and cons of adding it to your insurance policy before making a decision.

Speaking with a licensed insurance agent can help you understand your options and tailor coverage to your individual needs.

Considerations Before Purchasing

When considering purchasing a new car, it’s important to evaluate whether Gap insurance is right for you. Gap insurance is designed to cover the difference between the amount owed on a car loan and the actual cash value of the vehicle at the time of loss, which can occur in the case of theft or an accident that results in the total loss of the car. Gap insurance can be beneficial for those who have financed their car with little to no down payment, or if the car loan has a high interest rate.

It’s also important to consider the type of car you are purchasing, as Gap insurance may not be necessary for vehicles that retain their value well. Ultimately, the decision to purchase Gap insurance should be based on your specific financial situation and the risks associated with your car loan.

Alternatives to Gap Insurance

When purchasing a car, it’s important to consider whether or not gap insurance is right for you. While it can be useful in situations where your vehicle is totaled or stolen and the payout from your insurance policy falls short of what you owe on your loan, it’s not the only option. One alternative is simply making a larger down payment on your car, which can help reduce the amount you owe and lower the risk of being “upside-down” on your loan in the event of an accident.

Another option is to purchase a vehicle warranty that includes coverage for total loss situations. Ultimately, the best choice will depend on your individual circumstances and financial situation. It’s important to carefully weigh your options and consider the potential risks and benefits before making a decision.

Final Thoughts

When it comes to purchasing insurance for your vehicle, one of the commonly asked questions is whether State Farm offers gap insurance. The answer is yes, State Farm does offer gap insurance as an add-on to your existing auto insurance policy. Gap insurance is designed to protect you in the event of a total loss or theft of your vehicle, where your insurance payout may not cover the full cost of your outstanding auto loan.

Gap insurance covers this shortfall and can provide peace of mind knowing you won’t be caught in a financial bind. While it may not be necessary for everyone, it’s worth considering if you’ve recently purchased a new car or if you owe more on your current vehicle than it’s worth. Give your local State Farm agent a call to discuss whether gap insurance is the right choice for you.

Conclusion

So, does State Farm offer gap insurance? Well, it’s safe to say that they don’t leave a gap in their coverage options! See what I did there? But in all seriousness, yes, State Farm does offer gap insurance for those who want that extra peace of mind knowing their car is fully covered in case of an accident or theft. Don’t let a gap in your insurance coverage leave you stranded – contact State Farm for all your insurance needs.

FAQs

What is gap insurance?

Gap insurance covers the difference between the actual cash value of a vehicle and the amount you owe on it.

Does State Farm offer gap insurance?

Yes, State Farm offers gap insurance as an add-on to their auto insurance policies.

How much does gap insurance cost at State Farm?

The cost of gap insurance varies depending on multiple factors such as the type of vehicle and coverage limits. You can contact State Farm for a personalized quote.

Does State Farm gap insurance cover leased vehicles?

Yes, State Farm’s gap insurance covers leased vehicles.

Is State Farm gap insurance transferable to a new vehicle?

Yes, if you purchase a new vehicle, State Farm allows you to transfer your gap insurance coverage to the new vehicle.

When is the best time to purchase gap insurance from State Farm?

It is recommended to purchase gap insurance at the time of buying or leasing a new vehicle to ensure full coverage from the start.

Can I cancel my State Farm gap insurance policy at any time?

Yes, you can cancel your gap insurance policy at any time, but you may incur a cancellation fee.