Ohio Sales Tax on Cars: Everything You Need to Know If you are thinking of buying a car in Ohio, there are a lot of things you need to know, especially when it comes to sales tax. Sales tax laws in Ohio can be somewhat confusing, and it’s important to understand them properly to avoid any hassles or legal issues. In this blog post, we will explain everything you need to know about Ohio sales tax on cars, so you can make an informed decision and drive away with a car that suits your needs and budget.

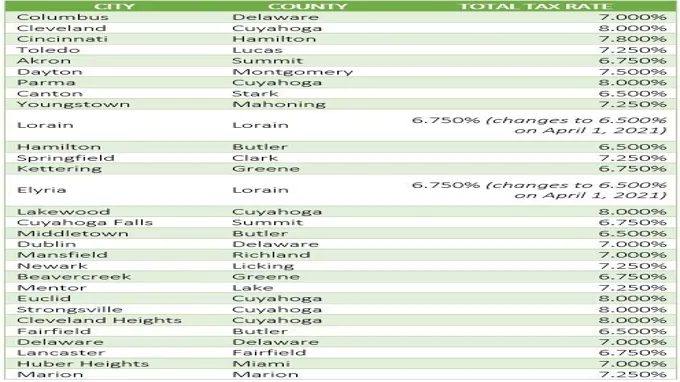

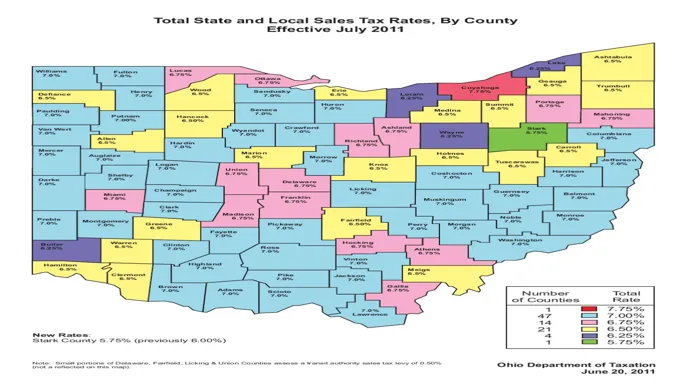

Did you know that sales tax in Ohio can vary depending on where you live in the state? The sales tax rate in Ohio is currently at 75%, but some counties and cities have additional taxes that can increase the rate. For instance, in Cuyahoga County, the sales tax rate is

0%, while in Columbus, it’s 5%. So, the city and county where you purchase your car will determine how much sales tax you need to pay.

Moreover, the Ohio sales tax on cars also applies to used cars, as well as new ones. In fact, the sales tax applies to the purchase price of the car, whether the dealer or private party sold it, or if it’s gifted. That means you need to take into consideration the sales tax in addition to the cost of the car you intend to buy.

So, what are the exceptions and exemptions for Ohio sales tax on cars? Certain situations, such as purchasing a car for business purposes, may qualify for a lower tax rate or an exemption from sales tax altogether. Additionally, if you are a military service member who is a resident of Ohio but serving in another state, you may also qualify for an exemption. In conclusion, understanding Ohio sales tax on cars is essential when purchasing a vehicle in Ohio.

By knowing how the sales tax works and where to find exemptions and exceptions, you can save money and avoid any misunderstandings and legal implications.

Table of Contents

Understanding Ohio Sales Tax on Cars

If you’re planning on purchasing a car in Ohio, it’s important to understand the sales tax policies in place. The Ohio sales tax on cars is currently set at 75% of the purchase price, though this amount can vary slightly depending on the location of the purchase.

Additionally, there may be additional fees or taxes imposed based on factors such as the age of the vehicle or its fuel efficiency. These taxes and fees can add up quickly and may significantly impact the overall cost of your car purchase. To ensure you’re fully aware of all costs before making a purchase, it’s important to research and understand the tax policies in place in your area.

Whether you’re buying a new car or a used vehicle, taking the time to educate yourself on sales tax policies can help you make an informed decision and avoid any unexpected costs down the line.

What is Ohio Sales Tax?

Ohio sales tax is an important factor to consider when purchasing a car in Ohio. The sales tax rate in Ohio is currently 75% as of 2021, but it may vary depending on the county you’re in.

In some counties, you may have to pay an additional 5% or more in local sales tax. When buying a car in Ohio, the sales tax is based on the purchase price.

For example, if you buy a car that costs $10,000, you will owe $575 in sales tax. It’s important to keep in mind that the sales tax will be calculated on the vehicle’s price before any trade-ins or rebates. Understanding Ohio sales tax on cars is crucial to ensuring you have enough money to cover your new vehicle’s cost.

The sales tax can be a significant amount, so it’s important to factor it into your budgeting before making a purchase. Additionally, it’s important to remember that sales tax rates can change, so it may be beneficial to keep up-to-date with any changes that may occur in the future.

How is Ohio Sales Tax on Cars Calculated?

Ohio sales tax on cars Understanding Ohio sales tax on cars is important if you’re planning to purchase a vehicle in the state. The sales tax on cars in Ohio is calculated based on the purchase price of the vehicle. The current rate is

75%, but depending on the county you live in, you may need to pay an additional county tax. This means that the amount of sales tax you’ll pay could vary based on where you live and where you buy the car. It’s essential to keep in mind that some Ohio cities may also have a special tax rate that applies to certain items, including cars.

Therefore, it’s important to check with your local government authority to see if there are any additional taxes or fees that you need to pay when purchasing a car in Ohio. In Ohio, sales tax must be paid at the time of purchase, and the dealer is responsible for collecting and remitting the sales tax to the Ohio Department of Taxation. So, there you have it – a quick and straightforward explanation of Ohio sales tax on cars.

Are There Any Exemptions to Ohio Sales Tax on Cars?

If you’re planning to buy a car in Ohio, you should understand how sales tax works. In general, the state sales tax rate for vehicles is 75%, in addition to local taxes imposed by counties and municipalities.

This means that the total sales tax on cars in Ohio can range from 50% to 8%. While there are no exemptions to the state sales tax on vehicles, some buyers may qualify for a partial exemption on the purchase price based on their trade-in vehicle.

This means that you may only be required to pay tax on the difference between the purchase price and the trade-in value. However, keep in mind that this exemption has limits, and some restrictions may apply depending on the specifics of your transaction. It’s always a good idea to consult with a tax professional or the Ohio Department of Taxation for guidance to ensure that you are complying with all relevant laws and regulations.

How to Calculate Ohio Sales Tax on Cars

If you’re planning to purchase a car in Ohio, it’s important to factor in the sales tax in your budget. The Ohio sales tax on cars is currently 75%, calculated based on the taxable vehicle price.

To calculate the taxable vehicle price, you’ll need to add the cost of any additional features or accessories to the base price of the vehicle. Once you have the taxable vehicle price, you can then multiply it by 75% to get the total sales tax amount.

It’s important to note that there may also be additional fees like title and registration fees, which can vary based on the county you reside in. By doing your research ahead of time and understanding the calculation process, you can make a more informed decision when purchasing a car in Ohio.

Step One: Determine the Purchase Price of the Car

Calculating Ohio sales tax on cars requires you to follow a few simple steps. The first step is to determine the purchase price of the car. This includes the base price of the vehicle plus any additional fees such as delivery charges, documentation fees, and any other applicable dealer fees.

Once you have this information, you can calculate the sales tax by multiplying the total purchase price by the current state sales tax rate. In Ohio, the state sales tax rate is currently 75%, but this can vary depending on the location and municipality where the vehicle is being registered.

Keep in mind that if you are purchasing a used car from a private seller, the sales tax may not be included in the purchase price, and it will be up to you to handle the payment and registration process. It’s always a good idea to do your research ahead of time so that you can accurately calculate the sales tax and avoid any surprises down the road.

Step Two: Determine the Applicable Tax Rate

If you’re purchasing a car in Ohio, it’s crucial to understand how to calculate the applicable sales tax. The tax rate depends on the county where the car is registered, so it’s essential to determine the right rate before making a purchase. The easiest way to determine the tax rate is to use the Ohio Department of Taxation’s Sales and Use Tax Rates lookup tool, where you can search for the applicable rate by county or ZIP code.

The rates vary from county to county, but they range from 75% to 8%. Keep in mind that the tax rate can also change if you trade-in a vehicle or if you’re buying a new or used car.

In short, calculating Ohio sales tax on cars requires some knowledge of the location, trade-in value, and type of vehicle you’re purchasing. It’s always essential to consult with a professional who can guide you with the process and help you avoid any potential pitfalls.

Step Three: Calculate the Sales Tax Amount

Once you’ve determined the taxable price of your car, it’s time to calculate the sales tax that you’ll need to pay in Ohio. The current sales tax rate in Ohio is 75%, but depending on where you live, you may also need to pay an additional local sales tax.

To calculate the sales tax amount, multiply the taxable price of your car by the sales tax rate (expressed as a decimal). For example, if the taxable price of your car is $10,000 and the sales tax rate in your area is 75%, you would multiply $10,000 by 0.

0575 to get a sales tax amount of $57 Keep in mind that this is just an estimate, as your actual sales tax amount may vary depending on any additional local sales taxes and other fees that may apply. By understanding how to calculate Ohio sales tax on cars, you can budget appropriately to ensure that you’re not caught off guard by unexpected fees or expenses when purchasing a vehicle.

Ohio Sales Tax on Cars vs. Other States

If you’re planning to buy a car in Ohio, it’s important to understand how much you’ll be paying in sales tax. The Ohio sales tax on cars is 75% for most vehicles, but there are some exceptions to this rate.

For example, electric cars and other alternative-fuel vehicles are subject to a lower sales tax rate of 75%. On the other hand, heavier vehicles like trucks and trailers are subject to a higher rate of

25%. When compared to other states, Ohio’s sales tax rate on cars falls in the mid-range. Some states like Oregon and Montana have no sales tax on cars at all, while other states like Louisiana and Arkansas have much higher rates than Ohio.

It’s important to keep in mind that sales tax rates can also vary depending on the county or city where the car is purchased, so it’s important to check with the local tax authority to get an accurate estimate of how much you’ll be paying in sales tax.

How Does Ohio Sales Tax on Cars Compare to Other States?

When it comes to buying a car in Ohio, one important factor to consider is the sales tax. Ohio has a state sales tax of 75% on all vehicle purchases, which is lower than other states like California (

25%) and Florida (6%). However, it’s important to note that some cities and counties in Ohio might have an additional sales tax on top of the state rate. For instance, residents of Cincinnati might face a total sales tax rate of 7%, while those in Cleveland might pay up to 8%.

Overall, Ohio’s sales tax on cars is relatively low compared to some other states, but it’s useful to research the specific rates in your area before making any purchases.

What are the Differences in Calculation Methods?

When it comes to calculating sales tax on cars, Ohio has a slightly different process than other states. While many states base their sales tax on the full purchase price of the vehicle, Ohio only charges sales tax on the first $20,000 of that price. This means that if you buy a car for $30,000 in Ohio, you’ll only be charged sales tax on $20,000, not the full amount.

However, if you buy a car for $15,000 in Ohio, the sales tax will be based on the full purchase price. It’s important to note that this only applies to cars purchased within Ohio. If you buy a car in another state and bring it back to Ohio to register, you’ll be charged sales tax based on the full purchase price.

Understanding the differences in calculation methods can help you save money and make informed decisions when purchasing a car in Ohio.

Conclusion

In conclusion, Ohio sales tax on cars is just like any other tax – unavoidable and a necessary evil. But hey, at least you can take solace in the fact that you’re contributing to the state’s economy..

.one car purchase at a time. So, the next time you’re signing on the dotted line for your new wheels, just think of it as a small sacrifice for the greater good.

And, if all else fails, consider moving to Oregon – they don’t have sales tax at all. Just a thought.”

FAQs

1. What is the current Ohio sales tax rate on cars? A: The current Ohio sales tax rate on cars is 5.75%. 2. Are there any exemptions or discounts available for Ohio sales tax on cars? A: Yes, there are exemptions and discounts available for Ohio sales tax on cars, such as military personnel, disabled individuals, and trade-in vehicles. 3. Is the Ohio sales tax rate on cars different for new versus used vehicles? A: No, the Ohio sales tax rate on cars is the same for both new and used vehicles. 4. How is the Ohio sales tax calculated for cars purchased out of state? A: If a car is purchased out of state and will be registered in Ohio, the sales tax rate is based on the Ohio rate where the purchaser will be registering the vehicle. 5. Does Ohio charge any additional fees on top of sales tax for cars? A: Yes, there are additional fees such as title fees, registration fees, and documentation fees that are charged in addition to sales tax on cars in Ohio. 6. Can the Ohio sales tax on cars be financed as part of the vehicle purchase price? A: Yes, the Ohio sales tax on cars can be added to the car loan and financed as part of the vehicle purchase price. 7. How do I pay Ohio sales tax on a car purchase? A: Ohio sales tax on a car purchase can be paid at the time of registration or through the Ohio Business Gateway if purchasing the vehicle for business purposes.