If you’re thinking about purchasing a car, you may have come across the term “balloon payments” during your research. But what exactly are balloon payments, and how do they affect your car loan? Essentially, a balloon payment is a large payment that’s due at the end of your loan term. It’s called a balloon payment because it’s bigger than your regular monthly payments and “inflates” the total amount you owe.

Balloon payments can be beneficial in some situations, as they allow you to make smaller payments each month and then pay off the remaining balance at the end of your loan term. However, they can also be risky, as you’ll need to have enough money saved up to cover the large final payment. It’s important to fully understand the terms of your car loan, including any balloon payment requirements, before signing on the dotted line.

By doing so, you can make an informed decision about whether a balloon payment is the right choice for you and your budget.

Table of Contents

What is a Balloon Payment?

If you’ve ever looked into financing a car, you might have heard the term “balloon payment” thrown around. But what does it actually mean? Simply put, a balloon payment is a lump sum payment you make at the end of your car loan term. This payment is typically significantly larger than your regular monthly payments.

Balloon payments are often used in car financing agreements to lower your monthly payments during the loan term, making it more financially manageable. However, it’s important to keep in mind that this means you’ll owe a large sum of money at the end of your loan term. You can choose to either pay this balloon amount in full or refinance the payment at the end of your term.

In short, balloon payments can be a good option for those who need to lower their monthly payments but should be approached with caution to ensure you’re financially prepared for the lump sum payment at the end of the loan term.

Definition of Balloon Payment

A balloon payment is a lump sum payment made at the end of a loan term. Essentially, borrowers make smaller payments throughout the duration of the loan term and then make a larger, balloon payment at the end. Balloon payments are commonly used in loan agreements with lower monthly payments but higher total interest costs over the life of the loan.

They can be beneficial for some borrowers, particularly those with fluctuating income or who plan to sell the asset before the end of the loan term. However, they also come with risks for the borrower, as they may not be able to make the balloon payment when it becomes due, potentially resulting in default and loss of the asset. It is important for borrowers to fully understand the terms of their loan agreement before accepting a balloon payment arrangement.

How Balloon Payment Works on a Car Loan

A balloon payment is a lump sum payment that is due at the end of a car loan. This type of payment is typically offered as an option to reduce monthly payments for the borrower. However, it also means that there will be a large, final payment at the end of the loan term.

Balloon payments can be risky, as borrowers may not have the funds to cover the payment when it becomes due. In addition, the interest on the balloon payment can add up over time and end up costing more than the original loan amount. It’s important for borrowers to carefully consider the pros and cons of a balloon payment before choosing this type of loan structure.

If you’re unsure if a balloon payment is right for your financial situation, it’s always best to consult with a financial advisor or loan specialist who can help you make an informed decision.

Pros and Cons of Balloon Payments

If you’re considering financing a car, it’s essential to know what a balloon payment is. Essentially, a balloon payment is a lump sum payment that you’ll need to make at the end of your loan term. While this can help lower your monthly payments, it can also make for a more expensive car in the long run.

On the positive side, balloon payments can be attractive to those who want low monthly payments or have an uncertain future financial situation. Additionally, if you plan to sell your car before the balloon payment is due, you may not even need to make the payment. However, if you can’t make the balloon payment, you could risk losing the car or being forced to refinance.

Overall, it’s important to weigh the pros and cons of balloon payments before deciding if it’s the right option for you.

Advantages of Balloon Payments

Balloon payments can offer advantages for both the buyer and seller in certain situations, such as in real estate or car purchases. For the buyer, the advantage of a balloon payment is that it offers lower monthly payments compared to a traditional loan. This is because the majority of the loan balance is due at the end of the loan term, reducing the amount of the monthly payments.

Additionally, the buyer may be able to save money as they may be able to qualify for a larger loan amount due to the lower monthly payments. For the seller, a balloon payment can be beneficial as it allows for higher interest payments over the life of the loan. However, balloon payments also have their drawbacks.

They can lead to higher total interest paid over the life of the loan, and the buyer may not have the funds to make the final payment when it is due. It is important for both parties to weigh the pros and cons and carefully consider their financial situation before agreeing to a balloon payment arrangement.

Disadvantages of Balloon Payments

Balloon payments are a type of payment plan where a large lump sum payment is due at the end of the loan term. While these types of payments can offer lower monthly payments, they also come with some significant disadvantages. One of the biggest drawbacks of balloon payments is that borrowers may struggle to come up with the large amount due at the end of the term.

This can lead to defaulting on the loan or being forced to refinance. Additionally, balloon payments can be more expensive in the long run since interest will continue to accrue on the loan balance until the balloon payment is made. Overall, balloon payments can be a risky choice for borrowers and it’s important to carefully weigh the pros and cons before agreeing to this type of payment plan.

Factors to Consider Before Opting for a Balloon Payment

When considering a balloon payment, it’s important to weigh the pros and cons. On the one hand, a balloon payment can provide you with lower monthly payments for a period of time. This can make it easier to afford your car, house or other large purchase.

However, this comes at a cost. You’ll be required to pay a large sum of money at the end of the loan period, which can be a difficult financial burden to bear. Additionally, you may have to pay higher interest rates in order to qualify for a balloon payment plan.

Overall, it’s essential to take into account your financial situation and future plans before opting for a balloon payment. While it can be a great way to obtain lower monthly payments, it’s not the best option for everyone.

Alternatives to Balloon Payments

If you’re wondering what a balloon payment on a car is, it’s a lump sum payment due at the end of a financing term. Balloon payments can be a convenient option for those who want lower monthly payments during the loan term, but they can also be risky if you’re not prepared to pay the large sum at the end. Fortunately, there are alternatives to balloon payments that you can consider.

One option is to negotiate a longer financing term with lower monthly payments. Another option is to make additional payments throughout the loan term to reduce the amount due at the end. You could also consider refinancing your car loan or trading in your car for a new one before the term ends to help cover the balloon payment.

When deciding on the best option for you, it’s important to weigh the pros and cons of each and to consider your financial situation and goals.

Traditional Car Loans

Traditional car loans have been the go-to for most individuals when purchasing a vehicle. However, one aspect of these loans that can be a burden is the balloon payment due at the end of the loan term. This payment is a lump sum that is significantly larger than the monthly payments throughout the loan term.

It can be overwhelming and difficult to manage for some borrowers. Fortunately, there are alternatives to balloon payments that can make the car buying experience much smoother. One option is to consider a longer loan term with smaller monthly payments, which can help alleviate the pressure of a hefty lump sum at the end.

Another option is to consider leasing a vehicle instead of purchasing one. With a lease, there is no balloon payment at the end, and the monthly payments are typically lower. It’s important to weigh the pros and cons of each option and consult with a financial advisor to determine which one is best suited for your individual needs.

Leasing Options

Leasing a vehicle can be a great option for those who don’t want to commit to owning a car long-term or don’t want to make a large down payment. However, when it comes to leasing, there are often balloon payments at the end of the term, which can catch people off guard. Luckily, there are alternatives to balloon payments.

One option is to lease a vehicle with a residual value that is not guaranteed. This means that you won’t have a set balloon payment at the end of the term, but the leasing company will estimate the value of the car at the end of the lease. Another option is to choose a lease that includes an early buyout option.

This allows you to buy the vehicle before the lease term is up, avoiding the potentially high balloon payment. Both of these alternatives can provide peace of mind and flexibility when it comes to leasing a vehicle.

Choosing the Right Car Loan Option for You

A balloon payment in a car loan is an option where you agree to pay a lump sum amount at the end of the loan term. This option is attractive to some borrowers as it allows for lower monthly payments during the loan term. However, it also means that you will owe a significant amount of money at the end of the loan term.

Make sure you are comfortable with the balloon payment amount and have a solid plan for how you will pay it before choosing this option. Consider how it will fit into your budget and if it will be feasible to pay off the remaining amount or if you will need to refinance the loan. Additionally, it’s essential to read and understand all the terms and conditions of the agreement before signing.

In some cases, balloon payments may come with additional fees or higher interest rates, so be sure to compare all the available options and choose the one that best fits your financial needs and goals.

Conclusion

In short, a balloon payment on a car is like a grand finale to a fireworks show – it’s the big, flashy bang at the end that catches everyone’s attention. However, just like with fireworks, it’s important to make sure that you understand the risks and consequences before committing to a balloon payment. So, buckle up and do your research before hitting the road with this financial option!”

FAQs

What is a balloon payment on a car?

A balloon payment on a car is a large payment that is due at the end of a car loan term. It is typically much larger than the other monthly payments and is used to pay off the remaining balance of the loan.

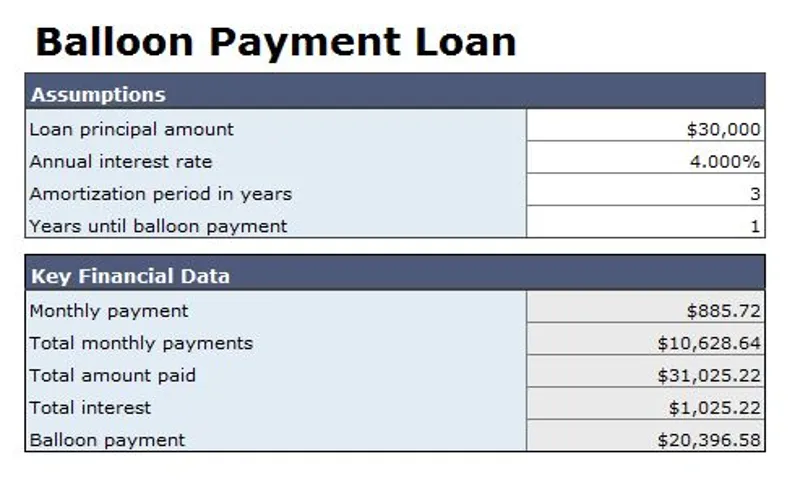

How is a balloon payment calculated on a car loan?

A balloon payment on a car loan is calculated by subtracting the value of the loan at the end of the loan term from its original value. The resulting amount is the balloon payment that the borrower will need to pay in order to fully own the car.

Can I negotiate a balloon payment on a car loan?

Yes, you can negotiate a balloon payment on a car loan with the lender. It is important to remember that the lender wants to receive the full value of the loan, so negotiating a lower balloon payment may not always be possible.

What happens if I can’t afford the balloon payment on my car loan?

If you cannot afford to pay the balloon payment on your car loan, you may be able to refinance the loan or negotiate a new payment plan with the lender. However, if you are unable to make the payment, the lender may repossess the car.

Are balloon payments a good idea for car loans?

Balloon payments can be a good idea for car loans if you have the ability to make the payment at the end and if it allows you to have lower monthly payments during the loan term. However, if you are unable to make the payment or if the interest rates are high, it may not be the best option for you.

Can I pay off my balloon payment early?

Yes, you can pay off your balloon payment early on a car loan. However, it is important to check with the lender to ensure that there are no early payment fees or penalties.

What are some alternatives to a balloon payment on a car loan?

Some alternatives to a balloon payment on a car loan include extending the loan period, making larger monthly payments, or avoiding the balloon payment altogether by saving for the full cost of the car upfront.