If you are looking to finance a vehicle, whether it’s for business or personal use, it’s essential to understand the concept of residual value. Residual value is the value that a vehicle holds after a certain period. This value plays a significant role in determining monthly payments and final payments, as lenders factor it in when calculating payment schedules.

But how do you find out the residual value of a vehicle? In this guide, we’ll take you through the process, examining various factors that influence residual value and how they affect your financing options. Get ready to learn an essential factor in auto financing!

Table of Contents

Understanding Residual Value

When purchasing a car, it’s important to understand what is residual value and how it affects the car’s worth over time. Residual value is the estimated value of a car at the end of a lease or loan term. This value is based on the car’s original price, miles driven, and wear and tear.

If you’re looking to find the residual value of a car, there are a few ways to do so. One way is to use online calculators, which take into account the car’s make and model, the length of the lease or loan, and other factors. Another way is to ask the car dealership or manufacturer, who may provide information on residual value as part of the sales process.

Understanding residual value can help you make informed decisions about buying or leasing a car, and can even affect your insurance rates and trade-in value in the future.

Definition of Residual Value

Residual Value Residual value is an industry term used to describe the estimated value of a product or asset after it has been used or depreciated over time. For example, in the automotive industry, residual value refers to the value of a car or truck after a certain number of years or miles have been driven. This value is important for leasing companies and lenders, as it helps them determine the residual value of the asset at the end of the lease term or loan agreement.

Understanding residual value is crucial for consumers as well, as it can affect the overall cost of ownership of the asset. For instance, a vehicle with high residual value will generally have lower monthly lease or loan payments than one with low residual value. The concept of residual value is also applicable in other industries, such as real estate and technology.

In real estate, it refers to the estimated value of a property after a certain term of lease or use. Meanwhile, in the technology industry, residual value refers to the estimated value of a device after a certain amount of usage.

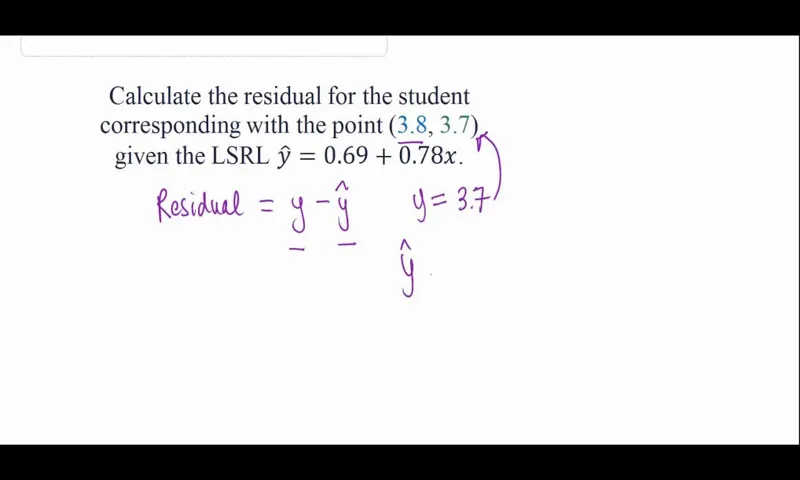

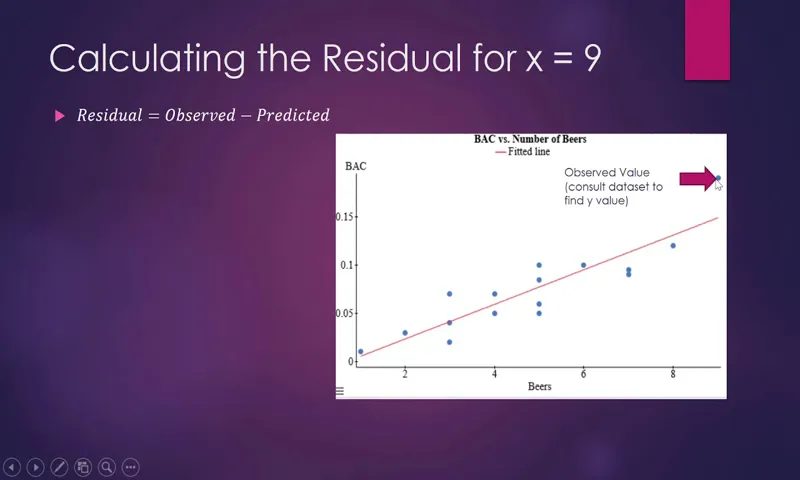

How Residual Value is Calculated

Residual Value Calculation Residual value is a term used to describe the estimated remaining value of a car or any other type of asset at the end of its lease or use. This value is calculated based on several factors such as the make and model of the car, the length of the lease, the current market value, and the expected wear and tear that the car will undergo during the lease period. Essentially, residual value is the difference between the car’s original value and its estimated value at the end of the lease period.

It’s important to note that residual value can be affected by several factors, such as the condition of the car at the end of the lease, the mileage covered during the lease period, and the market demand for that particular make and model. In order to get the most accurate estimate of residual value, it’s advisable to work with a qualified appraiser or leasing agent who can determine the best value for your vehicle.

Factors Affecting Residual Value

Residual value is the estimated value of a property or asset at the end of its useful life. It is important to understand the factors that affect residual value to help you determine the worth of your item or equipment. Generally, an item with a higher residual value means it holds its value better and can fetch a higher price when sold.

Some of the factors that affect residual value include the type and age of the property, the condition it is in, usage patterns, and market demand. For instance, the resale value of a three-year-old car with zero accidents and regular maintenance is expected to be higher than that of a similar car that has been involved in accidents and has not been regularly serviced. Similarly, the residual value of machinery used in harsh conditions or heavy use is likely to be lower than that used under normal operating environments.

By considering these factors, you can accurately predict the residual value of your property or asset and make informed decisions about their disposal.

Vehicle Brand and Model

When it comes to buying a vehicle, brand and model are two of the most crucial factors impacting the residual value. Luxury brands with a reputation for quality and durability often hold their value better than their non-luxury counterparts. Models with high demand and low supply also tend to have higher residual values.

For example, a Toyota Camry with low mileage will likely hold its value better than a Chrysler 300 with the same mileage. Other factors that impact residual value include the vehicle’s age, condition, mileage, and the current state of the market. While vehicles with a high residual value might cost more upfront, they often provide a better long-term investment.

Ultimately, it’s essential to consider the brand and model when selecting a vehicle, as they can have a significant impact on the car’s overall value over time.

Mileage and Condition

When it comes to selling your car, two important factors that can affect its residual value are mileage and condition. The more mileage a car has, the more wear and tear it may have experienced, leading to decreased value. If there are significant signs of damage, such as dents or scratches, this can also affect the value of the car.

On the other hand, a car in excellent condition with low mileage will likely maintain its value better. It’s important to keep up with regular maintenance and repairs to keep your car in top condition, which can help maintain its value in the long run. So, if you’re thinking of selling your car, take note of its mileage and condition and take steps to keep it in the best condition possible to ensure the best resale value.

Market Demand and Trends

One major factor that affects the residual value of a product is market demand and trends. The higher the demand for a particular product, the higher its residual value will be. On the other hand, if the product is no longer in demand, its residual value will diminish.

Additionally, trends play a significant role in determining the value of a product. Products that are currently in vogue will have a higher residual value as compared to products that are out of fashion. As such, those who are looking to invest in products with high residual values should always keep up to date with current market trends and demands.

This will help them make informed decisions on which products to invest in and which ones to avoid.

Ways to Find Residual Value

Residual value is an important factor to consider when leasing or buying a car, as it affects the car’s overall value down the road. So, how do you find the residual value of a car? One way is to check with the car manufacturer or a car valuation website. These sources can provide you with an estimated residual value based on the car’s make and model, its age, and its previous usage.

You can also consult with a car dealer or a finance specialist, as they can help you determine the car’s residual value based on market trends and specific lease terms. By considering residual value, you can make more informed decisions about your car purchase or lease and potentially save money in the long run.

Using Online Tools

If you’re thinking about buying or selling a vehicle, finding the residual value is an important part of the process. Fortunately, online tools can make it easier than ever before to determine the residual value of a car. You can use online valuation tools such as Kelley Blue Book or Edmunds, which take into account factors such as make, model, year, and mileage to provide an estimated residual value.

Alternatively, you could also utilize residual value calculators to determine the value of your car. These calculators factor in depreciation, mileage, and other factors that can affect the value of your car. For individuals looking to sell their vehicle, these tools can be incredibly helpful for determining a fair and equitable price.

Similarly, buyers can use these tools to negotiate a better price when considering purchasing a car. By using these online tools, you’ll be able to find a reliable residual value that will ensure that you’re getting a fair deal for your car.

Consulting Industry Experts

If you’re in the consulting industry, you know the importance of finding residual value for businesses. One of the first ways to find residual value is by calculating the net present value of an investment. By looking at the present value of future cash inflows and outflows, you can determine the value of the investment over the course of its lifespan.

Another way to find residual value is by analyzing the cost of capital and forecasting future cash flows. Once you have a solid understanding of a company’s cash flow and potential for growth, you can determine the residual value of any potential investment. Additionally, it’s important to look at industry trends and benchmarks to ensure that you are accurately evaluating a company’s potential value.

By using these methods, consulting industry experts can find residual value and make informed decisions for their clients.

Maximizing Your Residual Value

If you’re looking to get the most out of your vehicle’s resale value, a good place to start is understanding the concept of residual value. Put simply, residual value is the estimated worth of a vehicle at the end of its lease or ownership term. To find the residual value of your car, there are a few things to consider.

First, research the make and model of your vehicle to determine what it’s worth brand new. Second, take note of the current condition and mileage of your vehicle, as these factors can significantly impact its value. Finally, consider any additional upgrades and maintenance you’ve done that may increase its worth.

Remember, keeping your vehicle in good condition and taking care of necessary repairs can ultimately help you maximize its residual value when it comes time to sell or trade in.

Proper Maintenance and Repairs

Proper maintenance and repairs are essential when it comes to maximizing your car’s residual value. Regular servicing, oil changes, tire rotations, and brake inspections should all be part of your vehicle’s routine maintenance schedule. Neglecting these simple tasks may cause minor issues to flourish into larger, more expensive problems that could undermine your car’s value.

It’s also essential to address any issues that arise promptly. Simple repairs such as replacing a broken taillight or repairing a dent can save you money in the long run and help prevent further damage to your car’s value. By following a regular maintenance schedule and addressing repairs promptly, you can ensure that your vehicle stays in top condition and retains its value for years to come.

With proper care, your car can be an asset long after its loan is paid off.

Taking Care of Wear and Tear

When it comes to taking care of your car, it’s important to not overlook the impact that wear and tear can have on your residual value. Maximizing your car’s residual value means taking care of any visible damage or wear and tear as soon as possible. This includes things like scratches, dents, and interior tears.

By minimizing the amount of wear and tear on your car, you can keep your car looking newer for a longer period of time, which can help increase its resale value. When it comes to maintaining your car’s condition, it’s important to stay on top of regular maintenance like oil changes and tire rotations. By keeping your car properly maintained, you can minimize the impact of wear and tear and ensure that your car is in the best condition possible.

Overall, taking care of your car’s wear and tear is a critical part of maximizing its residual value, so take the time to stay on top of maintenance and address any issues as soon as they arise.

Negotiating End-of-Lease Terms

Negotiating the end-of-lease terms of your car can be a stressful experience. You want to make sure that you are getting the best possible deal while also maximizing your residual value. One way to do this is by carefully reviewing your lease agreement and identifying any excess wear and tear charges that may be added to your final payment.

By addressing these issues early on in the negotiation process, you can avoid any surprises and potentially save yourself a significant amount of money. Additionally, it can be helpful to gather information about the current market value of your car and use this as a bargaining chip when negotiating your lease terms. Remember, when it comes to negotiating the end-of-lease terms, knowledge is power.

By being informed and proactive, you can make sure that you are getting the most out of your lease agreement and maximizing your residual value.

Conclusion

In conclusion, finding residual value can be a bit like searching for hidden treasure – it requires some digging and investigation. But with a sharp eye and a bit of financial know-how, it’s a task that anyone can master. Whether you’re looking to buy or sell a car, a property or any other asset, learning how to calculate residual value is an essential skill that can help you save money, make smarter investments and unlock hidden value.

So don’t be intimidated by the math – with a little persistence and a lot of determination, you too can uncover the hidden gems of residual value and reap the rewards.”

FAQs

What is residual value?

Residual value is the estimated remaining value of an asset at the end of its useful life.

How is residual value calculated?

Residual value is calculated by subtracting the depreciable cost of an asset from its original cost.

Why is residual value important?

Residual value is important because it helps determine the overall cost of an asset and its potential value at the end of its life.

What factors affect residual value?

Factors that can affect residual value include market demand, technological advancements, and the condition of the asset.

Can residual value change over time?

Yes, residual value can change over time based on factors such as market demand, condition of the asset, and adjustments to depreciation methods.

How can residual value be maximized?

Residual value can be maximized by properly maintaining and caring for the asset, and considering market demand and potential technological advancements.

What happens if the actual residual value is different from the estimated residual value?

If the actual residual value is different from the estimated residual value, it can result in a gain or loss for the company when the asset is sold or disposed of.