When it comes to buying a car or any other high-value asset, calculating residual value can be one of the most crucial steps in making an informed decision. But what exactly is residual value, and why does it matter? In simple terms, residual value is the estimated worth of an asset after a certain period of time or use. This value is particularly important when it comes to leasing or financing a car, as it determines how much the car will be worth at the end of the lease term or loan period.

Understanding how to calculate residual value can help you make smart financial decisions and ensure that you’re getting the best deal possible. So, whether you’re in the market for a new car or simply curious about residual value, keep reading for a simple guide on how to calculate this important figure.

Table of Contents

What is Residual Value?

Residual value is an important concept to understand, especially if you’re in the market for a leased car or planning to sell a vehicle. Essentially, residual value is the estimated value of a car at the end of its lease or useful life. This calculation takes into account factors such as depreciation, wear and tear, and market conditions.

To calculate residual value, you need to determine the original cost of the vehicle, the expected length of the lease or useful life, and a residual factor provided by the leasing company. Then, you can multiply the original cost by the residual factor to get the residual value. This amount is important because it affects how much you can sell the car for or how much you’ll have to pay if you want to buy the car at the end of your lease.

Description of residual value

Residual Value Residual value refers to the estimated value of an asset at the end of its useful life or lease term. This value is determined based on various factors, including the asset’s condition, age, and market demand, among others. It is commonly used in the automotive and real estate industries, where it serves as a crucial parameter for assessing the economic value of an asset.

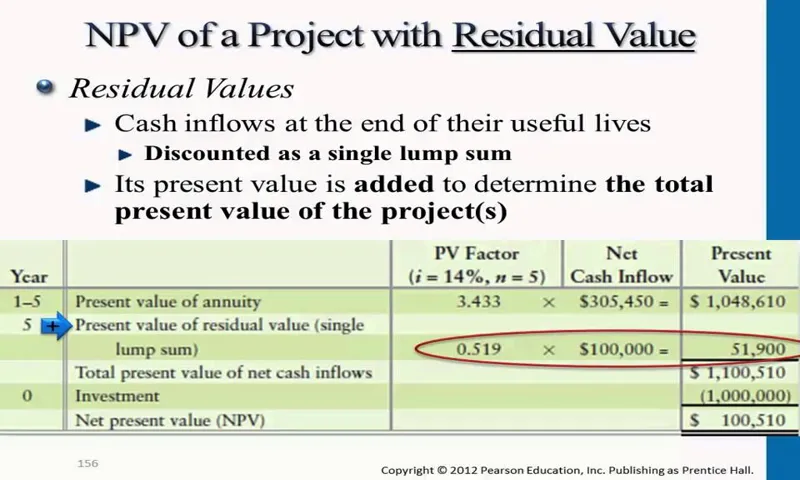

For instance, in the car leasing market, residual value is used to determine the monthly lease payments. A higher residual value implies a lower monthly payment, making the lease more affordable. Similarly, in real estate, residual value helps investors determine the profitability of a property investment.

The residual value of a building is calculated by estimating future cash flows and discounting them to present value. Residual value plays a significant role in financial planning and decision-making. By determining the residual value of an asset, businesses and investors can make informed decisions regarding purchase, lease, or disposal.

It provides vital insights into the long-term economic value of an asset, helping businesses and investors mitigate risks and maximize returns. In conclusion, residual value is a crucial concept that serves as a yardstick for determining the economic value of an asset. By estimating the residual value, businesses and investors can make informed decisions regarding the investment, utilization, and disposal of assets.

It is an essential tool for financial planning, risk mitigation, and maximizing returns.

Factors Affecting Residual Value

Calculating the residual value of a product is a crucial aspect that determines its overall worth. There are several factors that affect the residual value of an asset such as the quality of the product, depreciation, usage, demand, and market conditions. A high-quality product that is well-maintained will have a higher residual value compared to a low-quality product that has not been well-maintained.

Depreciation is another crucial factor that impacts residual value over time, as well as usage and wear and tear. In addition, market demand and conditions are also essential factors that determine the residual value of an asset. Understanding how to calculate residual value is an important skill that can help businesses and individuals make informed decisions regarding investments and sales.

Depreciation rate

Depreciation rate When it comes to purchasing assets, one of the most important factors to consider is the rate of depreciation. This refers to the amount an asset decreases in value over time due to wear and tear, market demand, and other factors. Residual value is the estimated value of the asset at the end of its useful life.

Understanding the factors that affect residual value can help you make better decisions when purchasing assets. Some of the most important factors include the age and condition of the asset, the availability of replacement parts, and the overall market demand for similar assets. By carefully considering these factors, you can choose assets that are likely to retain their value over time, which can help you save money in the long run.

So if you’re in the market for new assets, be sure to keep depreciation and residual value in mind when making your purchasing decisions.

Mileage

When it comes to the residual value of a car, mileage is one of the key factors that can impact its worth. Generally speaking, the higher the mileage a vehicle has, the lower its residual value will be. This is because a car with more miles on it is perceived as being more worn-down and less reliable, which can make it less desirable to potential buyers.

Of course, there are exceptions to this rule, with some cars holding their value better than others even with high mileage. Some factors that can influence this include the make and model of the car, the condition it’s in, and how well it was maintained. Ultimately, if you’re hoping to sell your car in the future and want to get the most money for it, it’s important to be mindful of the miles you’re putting on it, and to take good care of it so that it stays in good condition.

Vehicle age

As a vehicle owner, it’s essential to understand the factors that impact your car’s residual value. One of the most significant factors is the age of your vehicle. Generally, newer cars tend to hold their value better than older ones, but the depreciation rate can vary depending on several factors.

Luxury cars typically experience a steeper drop in value in the first few years of ownership, while more affordable models tend to hold onto their value longer. However, as a vehicle ages, it’s inevitable that it will experience wear and tear and other factors such as engine problems, which can impact its value. Regular maintenance, such as oil changes and other preventative measures, can extend the lifespan of your car, but eventually, all vehicles will experience depreciation.

Therefore, it’s essential to keep this in mind when purchasing a car and considering its long-term value. By doing so, you can make more informed decisions when it comes time to sell or trade-in your car.

Market demand

Market Demand The market demand for a particular type of asset is a crucial factor that affects its residual value. When there is a high demand for an asset, its value tends to remain higher even after it has been used for some time. This is because people are willing to pay more for an asset that is in demand, even if it has a few miles on it.

On the other hand, assets that have low demand tend to see a drop in prices very quickly, even if they are in relatively good condition. This is particularly true for assets like cars, electronics, and machinery, where new models are constantly being released, and consumers are always seeking the latest technology. Therefore, when investing in assets or selling used assets, it is important to consider the market demand for those assets to determine their residual value.

Methods for Calculating Residual Value

If you’re looking to calculate the residual value of a car, there are a few different methods you can use. One common approach is called the lease-end residual value method, which is typically used for leased vehicles. With this method, you’ll estimate the value of the car at the end of the lease term and subtract that from the original cost of the vehicle.

Another method is the straight-line depreciation method, which is used for both leased and purchased vehicles. This method involves estimating how much the car will depreciate in value over the course of its useful life and subtracting that from the original cost. There are also more specialized methods that take into account factors like the resale value of similar vehicles on the market.

No matter which method you use, it’s important to factor in all relevant variables and make realistic assumptions about future trends in the auto market. By doing so, you’ll be able to get a more accurate estimate of the residual value of your vehicle and make more informed decisions about financing or leasing options.

Straight-line method

One of the most commonly used methods for calculating residual value in depreciation is the straight-line method. This method is straightforward and easy to use, making it a popular choice for businesses of all sizes. The concept of the straight-line method is simple – it assumes that an asset depreciates in a linear fashion over the course of its useful life.

This means that the value of the asset decreases by the same amount each year, until it reaches its residual value, which is the estimated value of the asset at the end of its useful life. To calculate the depreciation using this method, you simply divide the original cost of the asset by the number of years it will be in use, which gives you the amount of depreciation that will occur each year. While the straight-line method is not perfect, it remains a reliable option for businesses looking to calculate residual values and is considered a tried-and-true method for many.

Diminishing balance method

The diminishing balance method is one of the most popular ways to calculate residual value. This method assumes that the asset being depreciated will lose value at a faster rate in the early years of its life and then at a slower rate as it gets older. This method is commonly used in situations where an asset’s value is heavily concentrated in the early years of its life.

For example, a new car may lose up to 20% of its value in the first year, and then only 10% each year afterwards. The diminishing balance method takes this into account and calculates the asset’s residual value accordingly. This method can be more accurate than other methods, but it requires more calculations and may not always be suitable for every situation.

Calculating Residual Value: Step-by-Step Guide

If you’re looking to purchase a vehicle or simply want to know its worth, calculating the residual value is an essential step. Residual value represents the estimated worth of a vehicle at the end of a lease or its useful lifespan. To calculate the residual value, start by determining the vehicle’s initial purchase price and its expected depreciation over time.

This is usually expressed as a percentage and can be based on various factors, such as the vehicle’s model, mileage, and condition. Next, subtract the depreciation amount from the initial purchase price to get the vehicle’s net residual value. Keep in mind that residual value calculations can be complex and may require additional factors such as interest rates and inflation, so consider consulting an expert if you’re not confident in your calculations.

By knowing a vehicle’s residual value, you can make informed decisions when buying or leasing a car and negotiate better deals.

Determining original cost

When looking to calculate the residual value of an asset, it’s important to first determine its original cost. This can be done by looking at the purchase price of the asset, as well as any costs associated with acquiring and installing the asset, such as delivery and setup fees. Additionally, you’ll want to factor in any discounts or rebates that were received at the time of purchase.

Once you have a clear understanding of the original cost, you can then move on to calculating the residual value of the asset. This can be done by estimating the useful life of the asset and determining the amount it’s likely to be worth at the end of that period. By following this step-by-step guide, you can better understand the value of your assets and make more informed financial decisions.

Determining useful life

Residual Value Determining the useful life of an asset is important when calculating its overall value. One key factor in this calculation is determining the asset’s residual value. The residual value is the estimated value of the asset at the end of its useful life.

This value is subtracted from the initial cost of the asset to determine its depreciation expense. To calculate the residual value, you should consider factors such as the condition and expected usage of the asset. If you estimate that the asset will have a high salvage value at the end of its useful life, this will factor into its residual value.

Conversely, if the asset is expected to have a low salvage value, this will decrease its residual value. By taking all these factors into account, you can calculate the residual value and create a comprehensive depreciation schedule that accurately reflects the true value of the asset.

Determining depreciation rate

When it comes to determining the depreciation rate of an asset, calculating the residual value is a crucial step. Residual value refers to the estimated value an asset will hold at the end of its useful life. To calculate this value, first determine the useful life of the asset, or how long it is anticipated to be used.

Next, consider any salvage value, or the estimated value the asset will hold at the end of its useful life. Subtracting the salvage value from the original cost of the asset will give you the depreciable base. To calculate the straight-line depreciation rate, divide the depreciable base by the useful life of the asset.

The resultant percentage is the amount by which you can write off the asset each year until it reaches its residual value. Accurately determining the residual value is essential as it affects the amount of depreciation that is recognized each year and therefore impacts the organization’s financial statements.

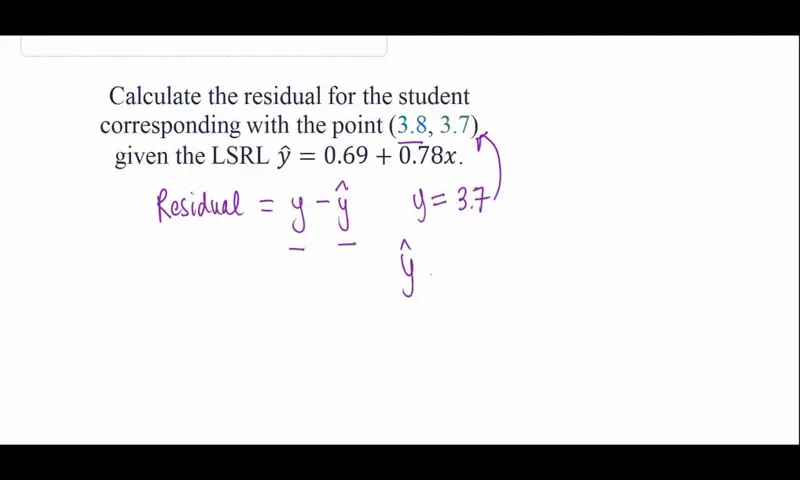

Calculating residual value

Calculating residual value is an essential process when buying or leasing a car. The residual value refers to the estimated value of the vehicle at the end of the lease term or when it’s sold. It’s calculated by taking the original purchase price and subtracting the depreciation over time.

To calculate the residual value, you need to know the car’s make and model, purchase price, lease term, and expected mileage. You also need to consider factors such as wear and tear, maintenance costs, and market demand. One way to estimate residual value is to look at the depreciation rate of similar cars and adjust for the specific circumstances of your lease or sale.

It’s important to remember that the residual value can impact your monthly lease payments and the overall cost of ownership. So, taking the time to calculate it accurately can save you money in the long run.

Conclusion

In the end, calculating the residual value boils down to one simple question: how much is left in the tank? Like a gas gauge, the residual value measures the remaining worth of an asset after it has gone through its useful life. It requires a bit of foresight, a dash of projection, and a whole lot of math. But by taking into account factors such as depreciation, maintenance costs, and market trends, you can get a good estimate of what your asset will be worth at the end of the day.

Just remember – when it comes to financial planning, the residual value is your trusty co-pilot, helping you navigate the twists and turns of business with confidence and precision.”

FAQs

What is residual value?

Residual value is the estimated value of an asset at the end of its useful life.

How is residual value calculated?

Residual value is calculated by subtracting the total depreciation from an asset’s original cost.

What factors determine the residual value of an asset?

Factors like the asset’s age, condition, and market demand can affect its residual value.

Can residual value change over time?

Yes, residual value can change as the asset ages or market conditions shift.

How does residual value affect lease payments?

A higher residual value can result in lower lease payments, while a lower value can increase payments.

What happens if the actual resale value of an asset is different from its residual value?

If the actual resale value is higher than the residual, the owner can receive a profit. If it’s lower, the owner may face a loss.

Is it important to consider residual value when purchasing an asset?

Yes, considering residual value is important as it affects the total cost of ownership and can impact future financial decisions.