Are you aware of disposition fees? These fees may not be well-known to car buyers, but they can have a significant impact on the cost of a lease or purchase. Disposition fees are charged by a dealership or leasing company at the end of a lease when the vehicle is returned. Many people are confused about what exactly disposition fees are, why they exist, and how they are calculated.

In this blog post, we will dive deeper into understanding disposition fees, explore their purpose, and provide insight into how they can be avoided or minimized. So buckle up and let’s get started!

Table of Contents

What is a Disposition Fee?

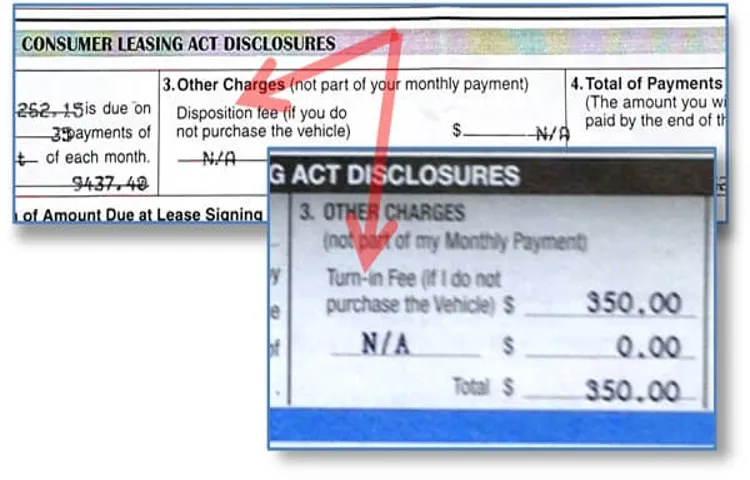

If you are in the market for a new car, you may have come across the term “disposition fee” while researching leasing options. A disposition fee is a charge that is applied by the leasing company at the end of your lease term. It is essentially a fee for returning the car at the end of the lease, which covers the costs associated with inspecting and preparing the vehicle for sale or lease to a new customer.

The fee can range from a few hundred dollars to several thousand dollars, depending on the terms of the lease and the make and model of the car. It’s important to be aware of this fee when considering leasing options, as it can add a significant cost to the overall expense of the lease. However, it can often be negotiated or waived altogether if you negotiate with the leasing company or choose to purchase the car at the end of the lease term.

Definition and Purpose

A disposition fee is a charge that lessees, or those who lease cars, pay when returning the vehicle at the end of the lease. This fee is generally associated with lease contracts for automobiles and is meant to cover the costs associated with preparing the vehicle for resale. The purpose of a disposition fee is to ensure that the lessee is responsible for any wear and tear on the vehicle or any damage that may have occurred during the lease period.

Essentially, the disposition fee is the cost of returning a car that has been used for a lease. In a way, it’s similar to paying a fee for returning a rental car. It’s important to note that disposition fees can vary from one leasing company to another, so it’s important to read and understand the terms of the lease agreement before entering into a lease contract.

Overall, the disposition fee is an important aspect of leasing a car and should be considered when deciding whether or not to enter into a lease agreement.

Charged by Dealers and Lease Companies

A disposition fee is a cost charged by dealers and lease companies to cover the expense of preparing a leased car for its resale after the lease term ends. It is essentially a fee for returning the car, and it can range from $300 to $500. This fee is often included in the fine print of lease agreements, which can be confusing for the lessee.

It is essential to read and understand the lease agreement thoroughly before signing it. The disposition fee is usually waived if the lessee decides to purchase the car after the lease term ends. It is a way for the lease companies to ensure that the car is in good condition upon resale and that any necessary repairs are made.

Understanding the disposition fee can help lessees make informed decisions when leasing a car and can help avoid unexpected fees at the end of the lease term.

How is a Disposition Fee Calculated?

If you’re leasing a car, you may be wondering: “What is a disposition fee?” This is a fee you’ll be responsible for paying at the end of the lease term when you return the vehicle. It’s meant to cover the costs associated with inspecting, cleaning, and preparing the car for resale. The amount of the disposition fee can vary and may be outlined in your lease agreement.

Typically, it’s around $300 to $500, but it could be more depending on the vehicle and the leasing company. It’s important to note that this fee is non-negotiable and cannot be waived, so it’s something you’ll want to factor in when considering the overall cost of leasing a car.

Fixed Amount or Percentage of MSRP

When it comes to leasing a vehicle, a disposition fee is often added to the final lease payment. This fee is charged to cover the cost of preparing the vehicle for sale once the lease term is up. But how is this fee calculated? Generally, a disposition fee is either a fixed amount or a percentage of the MSRP (Manufacturer’s Suggested Retail Price) of the leased vehicle.

The fixed amount is predetermined by the lease agreement, and the percentage is usually around 0.15% to 0.25% of the MSRP.

So, for example, if the MSRP of the leased vehicle is $30,000 and the disposition fee is 0.2%, the fee would be $60. It’s important to keep in mind that this fee is non-negotiable and cannot be waived.

Factors Affecting the Fee

When it comes to selling a property, a disposition fee is an important factor to consider. This fee is typically charged by the brokerage and covers the cost of marketing and selling the property. But how exactly is it calculated? Well, there are a few factors that come into play.

Firstly, the commission rate agreed upon with the brokerage will have a direct impact on the amount of the disposition fee. Typically, the higher the commission rate, the higher the fee. The second factor is the sale price of the property.

In general, the higher the sale price, the higher the disposition fee. Finally, the type of property being sold can also affect the fee. For example, selling a luxury home might result in a higher fee due to the specialized marketing and advertising required.

Overall, it’s important for sellers to understand how disposition fees are calculated and to negotiate these fees upfront with their brokerage.

When is a Disposition Fee Charged?

A disposition fee is a charge that is typically paid at the end of a car lease. This fee is charged by the leasing company to cover the costs associated with inspecting and preparing the vehicle for sale or transfer after the lease has ended. The amount of the disposition fee can vary depending on the leasing company and the terms of the lease agreement.

However, it is usually a fixed fee that is stated in the lease agreement. Some leasing companies may waive the disposition fee if you decide to lease or purchase another vehicle through them. It’s important to check the terms of your lease agreement to see if this applies to you.

If you’re nearing the end of your lease, it’s a good idea to start thinking about your options and whether or not you’ll be responsible for paying a disposition fee.

End of Lease

If you’re reaching the end of your lease agreement, you might be wondering what a disposition fee is and when it’s charged. A disposition fee is a fee charged by the leasing company at the end of your lease when you return the vehicle. This fee is meant to cover the costs of preparing the vehicle for sale or lease to another customer.

It’s important to note that not all leasing companies charge a disposition fee, and the amount can vary from company to company. Additionally, some companies may waive the fee if you decide to lease another vehicle from them. Be sure to read your lease agreement carefully and ask your leasing company about any fees that may apply at the end of your lease.

Returning a Leased Vehicle Early

If you’re considering returning your leased vehicle early, you might be wondering if you’ll be charged a disposition fee. The disposition fee is typically charged by the leasing company when you return the vehicle before the end of your lease term. It covers the cost of preparing the car for sale, including cleaning, inspection, and advertising.

The amount of the disposition fee varies depending on the leasing company and the terms of your lease agreement. Some leasing companies may waive the fee if you decide to lease or purchase another vehicle from them. It’s important to read your lease agreement carefully so you know what to expect if you decide to return your lease early.

By doing your research and understanding your options, you can make an informed decision about returning your leased vehicle early.

Can You Avoid a Disposition Fee?

If you are leasing a vehicle, you may come across the term “disposition fee” at the end of your lease term. A disposition fee is a charge that is applied by the leasing company when you return your vehicle at the end of the lease, and it covers the expenses associated with preparing the vehicle for resale, such as cleaning and inspections. However, there are some ways to potentially avoid a disposition fee.

One option is to negotiate the fee with your leasing company before signing the lease agreement. Another option is to buy the vehicle at the end of the lease term, which would eliminate the need to pay the disposition fee altogether. It’s important to read the fine print on your lease agreement and know what you’re getting into before signing on the dotted line to avoid surprises later on.

Lease Buyout

Lease buyout When you lease a car, you agree to make monthly payments for using the vehicle for a certain period of time. However, at the end of the lease term, you face a disposition fee if you decide to return the car. This fee covers the costs associated with inspecting, preparing, and selling the vehicle.

The amount of the fee varies depending on the leasing company, but it can be as high as several hundred dollars. One way to avoid this fee is to buy out the lease. This means that you purchase the car from the leasing company instead of returning it.

While this may seem like an expensive option, it can actually save you money in the long run. By buying out the lease, you avoid the disposition fee and can negotiate a lower price for the vehicle. Plus, you can continue to drive a car you’re already familiar with and have taken good care of.

Keep in mind that lease buyouts are not always the best option for everyone, so it’s important to consider your situation carefully before making a decision. If you’re unsure, it may be helpful to consult with a financial advisor who can help you weigh the pros and cons.

Negotiating with the Dealer

Negotiating with the dealer can be a daunting task, especially when it comes to avoiding a disposition fee. However, it is possible to approach this negotiation with confidence and a clear understanding of the process. First, it’s important to know what a disposition fee is and how it’s calculated.

A disposition fee is essentially a charge for returning a leased vehicle at the end of the lease period. This fee can vary depending on the dealer and lease agreement, but usually ranges from $300 to $500. To avoid this fee, you can negotiate with the dealer to waive it or include it in the overall lease agreement.

This can be done by demonstrating your loyalty to the dealership, agreeing to sign another lease agreement, or simply asking for it to be waived. Remember, negotiating with the dealer requires patience, persistence, and a willingness to walk away if a deal cannot be reached. By taking these steps, you may be able to avoid a disposition fee and save money in the long run.

Final Thoughts

In the world of car leasing, there are many terms that may sound unfamiliar to newcomers. One such term is the disposition fee. This fee is a charge that is applied at the end of a lease term and is meant to cover the costs associated with inspecting and preparing the car for resale.

It is important for lessees to be aware of this fee and how it may impact their lease agreement. While the disposition fee can vary depending on the leasing company, it is typically a few hundred dollars. Lessees should also be mindful of any other potential fees that may be applied at the end of their lease, such as excessive damage or mileage fees.

Overall, understanding the terms and fees associated with car leasing is an important aspect of being an informed consumer.

Conclusion

In conclusion, the disposition fee is the automotive industry’s way of saying ‘break-up fee’. It’s the cost you pay for ending your lease early and skipping out on the commitment you made to your vehicle. It may seem like a bitter pill to swallow, but when you consider the alternative (driving a car you’re not in love with for an extended period of time), it’s a small price to pay for vehicular happiness.

So, embrace your disposition fee and know that sometimes, parting ways with something you once loved is just a part of life.”

FAQs

What is a disposition fee?

A disposition fee is a charge that is applied by a leasing company or dealership when a customer returns a leased vehicle at the end of its lease term.

How much is the typical disposition fee?

The typical disposition fee can range from $300 to $500, depending on the leasing company or dealership.

Is a disposition fee negotiable?

In some cases, a disposition fee may be negotiable, particularly if you are leasing another vehicle from the same dealership or leasing company.

When is the disposition fee due?

The disposition fee is typically due when you return your leased vehicle.

Can I avoid paying the disposition fee?

The disposition fee is typically a required charge, but some leasing companies or dealerships may waive the fee if you lease or purchase another vehicle from them.

Is the disposition fee refundable?

No, the disposition fee is generally non-refundable once you have returned your leased vehicle.

What should I do if I can’t afford the disposition fee?

If you are unable to pay the disposition fee, you should speak with the leasing company or dealership to see if alternative arrangements can be made.